Contents

It would not be possible to classify markets as bullish, just by the action of CNX Nifty alone. Before we get into the specifics of the Dow theory let us take a live macro example. Assume that the Indian GDP is likely to shift up from 7% to 8% real growth and the profit growth of Indian companies in the coming quarter is likely to improve from 11% to 14%. At the same time, there is going to be short term volatility caused by the uncertainty surrounding the talks on the trade war between the US and China and the Fed action on rates. Here we can intuitively see three trends building up that emanates from different time period implications. These trend lengths are what Dow Theory is all about and based on their length and implication, these trends are referred to as Tides, Waves and Ripples.

Forex trading signals did no have to occur simultaneously, but the quicker one followed another – the stronger the confirmation was. Distribution phase – a new direction is now commonly recognized and well hiked; economic news are all confirming which all ends up in increasing speculative volume and wide public’s participation. According to Dow an uptrend is consistently rising peaks and troughs. And a downtrend is consistently rising lowering peaks and troughs.

Market Trends have Three Phases

This is the phase wherein the averages are already heading higher, and investor sentiment and business conditions start to improve. The third phase is the euphoria phase which eventually turns into distribution phase. This is the phase wherein speculation is rampant, and businesses and the economy are boiling with activity.

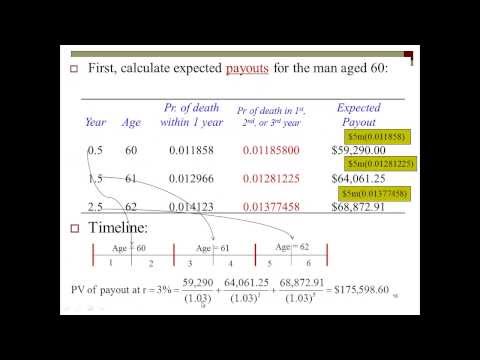

For an investor, this is the least important of all three trends. The primary trend represents the overall trend of the market and usually lasts anywhere between a year to several years. In a primary up trend, each high crosses the previous high and each low fails to cross the previous low. As long as this pattern continues, the primary uptrend is in effect. Similarly, in a primary down trend, each low crosses the previous low and each high fails to cross the previous high. As long as this pattern continues, the primary downtrend is in effect.

However, when significant price movements occurred with high volume, Dow believed that this gave a ‘true’ market view. Technical Analysis has some very solid roots, The Dow Theory. From 1900 to the time of his death in 1902, Charles Dow wrote a series of editorials published in The Wall Street Journal regarding his theory of the stock market.

- This demand and supply of shares is the sole reason we see fluctuations in the market.

- The Sensex and the Nifty are India’s two main wide market indices.

- From 1900 to the time of his death in 1902, Charles Dow wrote a series of editorials published in The Wall Street Journal regarding his theory of the stock market.

- The investors and traders that are often caught unaware are the ones normally doing all the buying during the distribution phase, buying from the smart money investors and traders.

With uncertainty abound and fears of further downtrend there are no buyers even though share prices tend to be at their rock bottom. They are not considered reliable to track market trend and are mostly fluctuations in the secondary or intermediate trend. The correction during this phase can be between one-third and two-third of the previous movement.

A trend is said to be continuous until a reversal is confirmed

This shows that a higher number of trades are following the downtrend, pointing to a bearish market. To identify that a trend has been established, it’s essential that all the market indices must confirm each other. So, the movement of one index must match the movement of all other indices in the market.

The Dow theory assumes that the averages discount every possible piece of information that could potentially impact the demand and supply of securities. The only exception to this is natural calamities, as these cannot be anticipated beforehand. Nonetheless, as these events occur, their impact is quickly analysed, priced in, and reflected in the averages . Update your email id and mobile number with your stock broker / depository participant and receive OTP directly from depository on your email id and/or mobile number to create pledge.

Her goal is to help readers make better investment decisions. The minor trend behaves like ripples which are formed when you throw a pebble into still water. Now, let’s move ahead and understand the six basic tenets of the Dow Theory. The Dow Theory is a theory based on observations of Mr Charles Dow.

The markets have three trends:

We highly suggest you to go through our other TA chapters as well. We have talked about volume sparsely in this module as well as in a few other modules. That said, we will surely come up with a dedicated chapter on Volume within the Technical Analysis module in the coming days… Movement in one average must always be confirmed by movement in the other average.

In a Bull Market, volume increases when prices rise and dwindles as prices decline; in Bear Markets, turnover increases when prices drop and dry up as they recover. As per the https://1investing.in/, The broad, overall, up and down movements usually last for more than a year and may run for several years. One was composed solely of the stocks of 20 railroad companies, for the railroads were the dominant corporate enterprises of his day and the other was called the Industrial Average. Dow states that this could be anything from less than a year to several years.

Buying penny stocks and its risks

Then comes a period that everyone says market at its peak and economy and everything is just awesome. Looking at above chart, Nifty is in primary uptrend and secondary trend is counter against the primary trend indicated by red arrow. At the same time minor trend is shown with blue arrows, which is usually called as noise too. During the market day, there are many fluctuations that often make lead traders and investors to make decisions that may or may not conform with the prevailing trend. However, at the end of the day, as the closing price approaches, most trader sand investors want ito tap into the current trend and this determines the closing price of the stocks.

Minor trends are the daily fluctuations in the markets that last for a few hours or a few days. Most traders and investors refer to the minor trends as market noise as they cannot be relied on to determine the correct trend. Minor trends can be in the direction of the primary trend or the secondary trend depending on the price movements. Dow theory posits that a bull market is comprised of three phases. This is the phase when the overall sentiment is very bearish, but informed investors, sensing that the averages have priced in most of the bad news, start accumulating stocks.

This phase occurs when institutional investors or smart investors have completely sold out their stake. And retail investors are still holding on to the shares bought by them. The stock prices might dip down a bit which creates fear and nervousness among retail investors and they start selling their stake at nominal profits or even losses. This selling pressure pushes the stock prices further down and leads to the accumulation phase again. Then, in the response phase, as short-term traders throng to the markets, we see a sharp rise in the index price from around 900 during May 2003 to around 2000 during January 2004. At this point, there’s a resistance that builds up since institutional investors start to sell off their holdings, leading to the formation of a distribution phase.

Which is saying that each successive wave that comes in is further away from the shore than the previous one. According to this theory there is an uptrend if each successive rally closes higher than the previous rally. The market is quick to assimilate and factor in all information that is known and available.

Sah Polymers Limited IPO – Price, Lot size, Open date, GMP & Review

So, after seeing a steep fall in the markets, investors sell their stake out of fear thinking that the stock prices will crash further. In this phase shares are available at attractive valuations. Smart investors or institutional investors keep looking for such accumulation opportunities. So, when retail investors are selling their holdings out of fear, smart investors accumulate stocks at attractive valuations. This restricts the stock prices to move further down and we see a sideways trend and support levels are formed.

Since both the indices have broken their resistance levels and risen past them one after the other, the stock market can be said to be in an uptrend according to the Dow Theory. According to the Dow Theory, the market has three simultaneous movements. Not even lower oil prices lately have helped the transports. Dow Theorists, and technicians more broadly, must monitor the August highs on both of these ETFs. We are in bearish mode, confirming the overall cyclical bear market, until new rebound highs on both the industrials and transports are made.

So you should look for the reversal signal during a uptrend or downtrend. If the uptrend or downtrend is not supported by volume means the trend is becoming weak and it may reverse after sometime. There are two types of investors Big investors like Institutes and Small investors like you and me. When the prices are down and everyone says market crashed and Amortization Financial Definition Of Amortization economy is doomed this big players slowly buy the stocks. The reason for this is that the uptrend shows strength when volume increases because traders are more willing to buy a stock in the belief that the upward momentum will continue. And on the other side, in a downtrend, volume must increase when the price falls and decrease when the price rises.

The market participant needs to tune himself to the idea of evaluating markets in the context of different phases, as this sets a stage for developing a view on the market. Therefore, one doesn’t have to try to figure out the accounting wizardry of a company to determine whether to buy the stock or not. All one has to do is look at the stock’s price and volume, and, know how to interpret that information. As you can see, the trend changes quickly and it sustains for a very short term. In the same chart above we have highlighted the secondary trend using a different time frame. This theory has laid the foundation of technical analysis and it is used by traders and analysts to analyse the next market move.